Gross margin is an essential concept, and is one of my favorite metrics in SaaS because it combines several key drivers of your business into one concise number. Gross margin is effectively a measure of a company’s efficiency and raw ability to be profitable, and is defined as:

(Revenue - Cost of Revenue) / Revenue

If Safeway sells you some bananas for a dollar, and it costs them $.80 to get those bananas, they have realized a gross margin of 20%: ($1 - $.80) / $1.

For tech companies, note that gross margin does not include costs such as sales, marketing, or engineering, but does include costs such as customer support, servers, and networking. The intuitive reason for this is that gross margin is based upon the gross profit you get from delivering a unit of value to your customer. In a perfect hypothetical world, your perfect product would require no additional development (no engineering) and everybody would want it (no sales and marketing). Gross margin measures your profit in that idealized universe.

Why Does Gross Margin Matter?

Gross margin is tremendously important for two reasons.

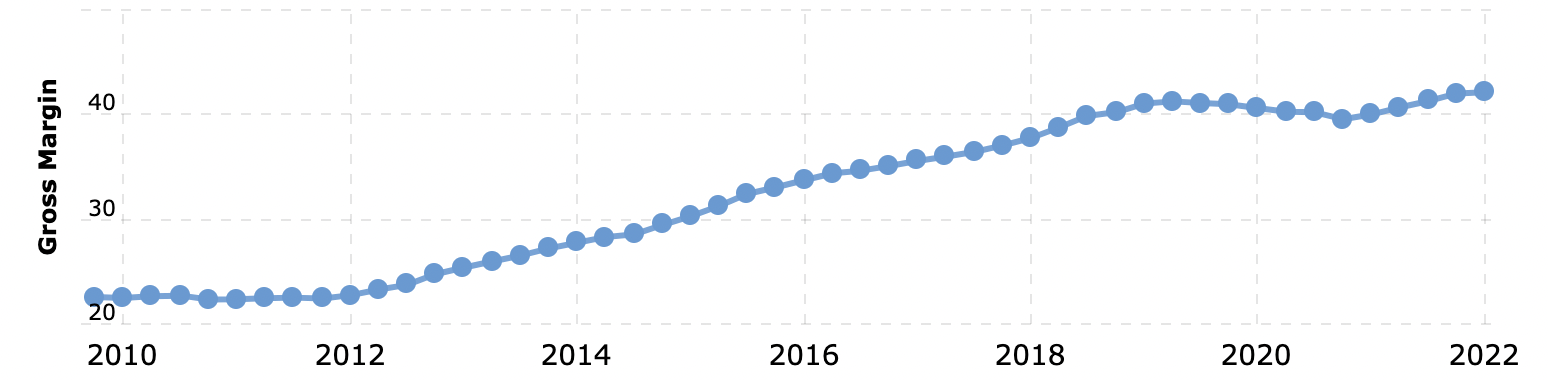

First, it’s a raw input to profitability - if I make more money when I sell each thing, then I make more money when I sell a lot of the things. Gross margin matters enormously at scale. Many of the most successful businesses in history (Apple, Google) have very high gross margins, which sets them up structurally to generate colossal profits at their size (there’s a lot more nuance here of course). In one way of thinking, gross margin adds more buffer and upside to your business.

Second, gross margin is a reasonable way to bucket businesses into different categories, because the gross margins that a company can achieve tend to be structurally fixed over time. Let’s look at that Safeway example – barring some Web3 revolution in which we only consume virtual banana NFTs, when you show up with your $1 Safeway still needs to find you some real goddamn bananas that grew on a real tree that sits in real soil. That all costs money.

But if you’re Google and you sell some people $1 worth of virtual ads, your costs round down to almost nothing. These are durable patterns that are enmeshed in the structure of the business. The CEO of Safeway will not wake up one day with an idea to procure, transport, and deliver bananas for 3 cents. Google will not wake up one day and need to pay 90 cents on the dollar to show you an ad.

This comparison also underpins why so many people called bullshit on WeWork for so many years. It was clear from very early on that WeWork was highly unlikely to generate software-like gross margins, despite its valuation.

This usage of gross margin to categorize businesses is particularly relevant for SaaS companies. Above 60-65% margins, you’re typically viewed as a software business and can command a high valuation (potentially >10x revenue) based upon expectations that you’ll be able to convert your revenue into high profits. Below that, in the 40-60% margin range, you start looking like an infrastructure company with a lower valuation multiple. Lower still, and you start to look like a consulting firm (1-4x revenue) or worse, a lemonade stand or a sandwich shop (valued at 0.5-3x profit). These businesses get much lower valuations due to their structural inability to top-tier unit economics.

What does this mean? If you are a SaaS company, your valuation can meaningfully change based upon your gross margin. And if you can increase your gross margin, you can turn a money faucet into a fountain.

How to Move Gross Margin

So we know what gross margin is and why it matters. What next? Similar to expanding your SaaS business, the challenge of how to increase your gross margin is a multiple choice question, not free response. Let’s dive in.

Increase Prices

This is the easiest and most obvious solution to low gross margins: just charge more. A lower percentage of low value deals = higher percentage of high value deals, which solves your problem almost immediately.

The obvious problem: increasing prices makes you less competitive, and if you have only a slim edge in the market you will lose deals based upon price. This will hit your topline revenue, and if you’re a SaaS company your topline revenue probably matters even more immediately to your valuation and ability to fundraise. One way to solve this is to scale the price of your product increases with the value delivered. For example, Slack charges by seat rather than by message, because they’re selling connectivity. In contrast, Stripe charges by transaction because their value add comes from making each transaction easier to process.

But be careful: while raising prices and sacrificing part of the market is good for your gross margins, it creates an opening for lower cost competitors to enter your market sustainably. This feeds long-term competitive threats. There’s a reason that Amazon and now Snowflake have actually dropped their prices as they’ve scaled: they’re going big and want to starve new market entrants in the crib. Dominating your market often requires lower gross margin in exchange for unlocking more total value if you dominate your market.

(A notable tech exception to this is Apple, which has premium pricing and dominates with brand marketing, among other areas where it’s best-in-class)

Reduce Your Percentage of Low Margin Deals

This concept may sound trivial or even tautological: Be less unprofitable to be more profitable, is Stay SaaSy a second grader? The reason this item makes the list is because the solution to having too many low margin deals is often fixing a sales pipeline problem.

Let’s say that you sell a secure database product to a wide range of customers. In the raw materials industry your gross margin is 80%, because big data for iron ore just isn’t that big. In the financial services industry, however, your gross margin is 50% because you have to handle billions of transactions. Figuring out how to get more customers from the raw materials industry is a key lever for increasing gross margin.

Sometimes this means changing your pitch, or doing better marketing to move to a different, more profitable market. Sometimes it also means adjusting your product for a higher margin sector. Targeting the right customers is a great way to move the needle on gross margin fast because you can potentially turn it around just in one or two quarters of focused pipeline generation.

Reduce Cost of Goods Sold

At a SaaS company there are two main ways to reduce cost of goods sold:

- Reduce the direct software costs associated with running your product.

- Reduce manpower that goes into cost of revenue – typically your support team, as well as some proportion of devops or customer success.

If your team is strong at engineering, look for ways to cut your software costs. Engineers love looking for cost savings because they’re fun and instantly gratifying - you can see the dollars as they get saved. Pro tip: try to frame all cost saving measures in terms of gross margin. People love making measurable optimizations, and the kudos that they earn.

From a management perspective, cost reduction via engineering is appealing because it’s a goal that can be made highly motivating. You have a score (gross margin) and you can move it fast. Merge code to cut costs in the morning, and watch the savings roll in that night. Clever teams will help engineering understand how costs impact the business and create strong visibility and incentives to drive them down.

If you have a high touch product that requires significant support, look for ways to make your product more self-serve. Improving UX to reduce support costs is a hard but even more rewarding way to improve your GM. It leads to higher customer satisfaction and improves the efficiency of your organization purely due to lower headcount. If you have a heavy support burden, removing hurdles that make your product harder to use can be very rewarding in terms of both customer satisfaction and margins at the same time.

Finally, you can control cost by using pricing or product limitations to bound your product’s operating parameters. Some of the worst cost overruns often come from a few customers who are behaving badly – imagine a large company using Slack to store all of their high resolution photos. As a product or pricing team you have two options when some dimension of your product can increase infinitely:

- Put a limit on it (you can have at most 10,000 messages in a free Slack account; images can be at most 4mb)

- Charge for it

Bonus – unbounded areas of your product are a common source of stability and performance issues, and you’ll dodge those too.

Sell Higher Margin Products

Some products are just going to inherently be higher margin than others. At the end of the day, a product like Jira or Confluence by Atlassian just doesn’t cost that much to run. Atlassian is an extremely successful company and there’s a lot going on under the hood, but at the end of the day you create a bunch of tickets or pages, throw them in a database, and return them by their IDs. Jira doesn’t need to stream video of Ariana Grande to millions of adoring fans (thank god). As a result, Atlassian boasts a very high gross margin.

A company like Zoom, by contrast, has margins that are meaningfully lower (although still really high for businesses in general). Zoom involves streaming video for conversations with more than 2 people, and presumably has significantly more overhead behind the scenes. Some features are more costly than others.

You can make your product less like Zoom and more like Atlassian: Build and sell higher margin products or add-ons as part of your overall offering. Examples might include an enterprise tier with more security or compliance offerings (features like user event logging or different user provisioning controls that are cheap to run but essential for the enterprise). Or maybe offer some kind of more comprehensive downtime monitoring system that adds significant value in an inexpensive way.

Changing your product mix to higher margin products is a strong way to improve your gross margin over time.

When to Optimize Your Gross Margin

In the earliest stages of a startup gross margin typically doesn’t matter much. Achieving product/market fit is much more important. As your startup scales up, having high gross margins isn’t necessarily critical, but being on track for high gross margin is. Businesses that look like they’re destined to have low gross margins are often essentially unfundable. Once you’re at high scale – say, north of $100M in annualized revenue and looking to go public or get a great acquisition, gross margins become critical and it’s time to start optimizing them, or at minimum picking the low-hanging fruit.

An Example

For a quick wrap-up, let’s look at the brilliant operators at Amazon. Amazon have largely dropped prices over time, lowering their gross margins but improving their ability to compete and scale. But still, they have:

- Made massive shipping infrastructure investments to drive down costs.

- Invested in automation and usability to reduce support and fulfillment costs.

- Released new high margin products like Kindle (how much does it actually cost to download Eat Pray Love?) and streaming.

- Expanded their business and changed their aggregate customer mix with higher margin products like AWS.

Amazon are a master class in harnessing and optimizing gross margin to achieve business goals.

It seems to be working out well for them.